Your credit score is the single most important factor that affects all types of financing and credit requirements that you might need from financial institutions. It is basically a representation of your track record of managing your finances and repaying debts. After all, lending money has its fair share of risks and lenders would like to have some form of assurance that their money is not going into the wrong hands.

Without a good credit score, you will have a face a lot of hurdles and problems while getting your home loan approved. If you want to avoid such problems, then make sure that you work on building and improving your credit score.

Limit Your Debts

If you don’t think you will be able to pay off the debt in a reasonable amount of time, then don’t take it on in the first place. Debts are good when planned and repaid properly. The longer your repayment duration, the more interest you will have to pay. This will definitely have an impact on your finances. The best way to tackle this situation is to pay more than the EMI and complete the debt as soon as possible. Credit cards have a higher interest rate than other types of loans so make sure to pay off the balance every month and don’t spend beyond your means. Also, avoid debts unless absolutely necessary. This will help you to avoid hassles.

Pay Your Bills on Time

Not paying your bills on time is one of the most common reasons credits scores are hitting the floor for so many people. Probably the most difficult thing is to keep a control on your expenses when you have credit cards at your disposal. When it comes to repayment, people usually go beyond the deadline and / or skip the monthly payment. This affects the credit score badly. If you are not able to repay the required amount, then pay AT LEAST the minimum BEFORE every due date.

Understand Your Credit Score

Do you know your credit score? Is it accurate? If you don’t understand your credit score, then it’s about time that you checked your report and took a better look at the finer details. The situation might be grimmer than you anticipate. Some of the important factors which affect your score are as follows.

Analyse the Credit System Applicable in Your Region

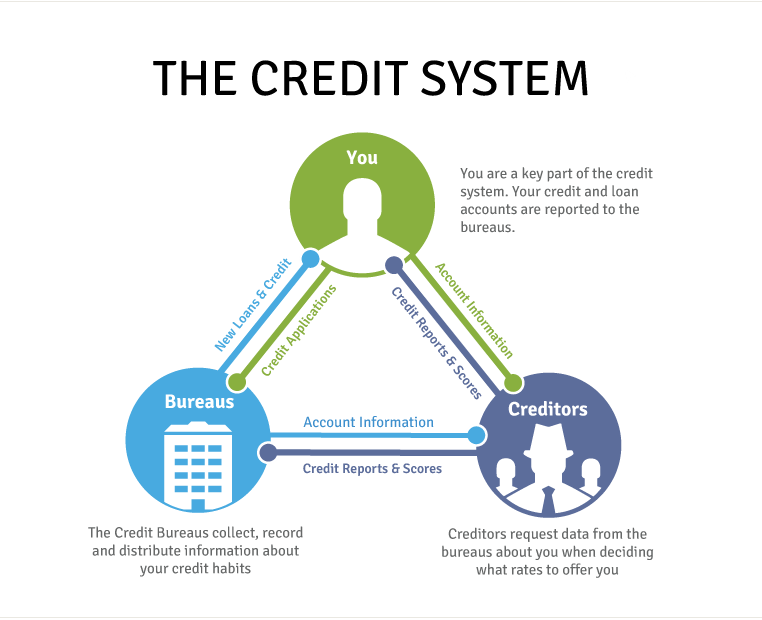

A credit reporting system is made up of three main players: consumers, credit bureaus and financial companies. You need to understand the system and find out the exact parameters and metrics that affect the credit score. Understanding the system will help you to use the system to your advantage by planning your finances and debts in such a way that it helps you in enhancing your score and providing you with a lucrative appeal.

The following diagram should help you to understand the relation between the important elements of the credit system.

Check and Remove Errors from the Reports

Statistics show over 80 percent of consumer’s credit reports have errors. This literally kills most credit scores. Most of the times, the errors are left in the report because they are not detected and modified accordingly. Don’t expect the authorities for you as they have thousands of reports to manage. You need to proactively check the reports and communicate errors and irregularities with supporting evidence. The sooner you clear the report of errors, the better your chances will be of getting an accurate credit score.